Why Compare Car Insurance Online?

The internet has revolutionized how we shop for just about everything, and car insurance is no exception. Comparing car insurance online offers several key benefits:

Convenience and Speed

Gone are the days of calling multiple insurance providers or visiting offices to get quotes. Online comparison platforms allow you to receive multiple quotes from different insurers in just a few minutes.

Access to Multiple Quotes

Online comparison tools bring multiple insurers to one platform, making it easy to compare premiums, coverage options, and additional benefits. Instead of manually checking individual websites, you can view all options at once.

Customizing Coverage

One of the main advantages of online car insurance comparison is the ability to tailor coverage options based on your needs and budget. Whether you’re looking for basic liability coverage or comprehensive insurance, online tools allow for easy customization.

The Benefits of Using Cashback Offers

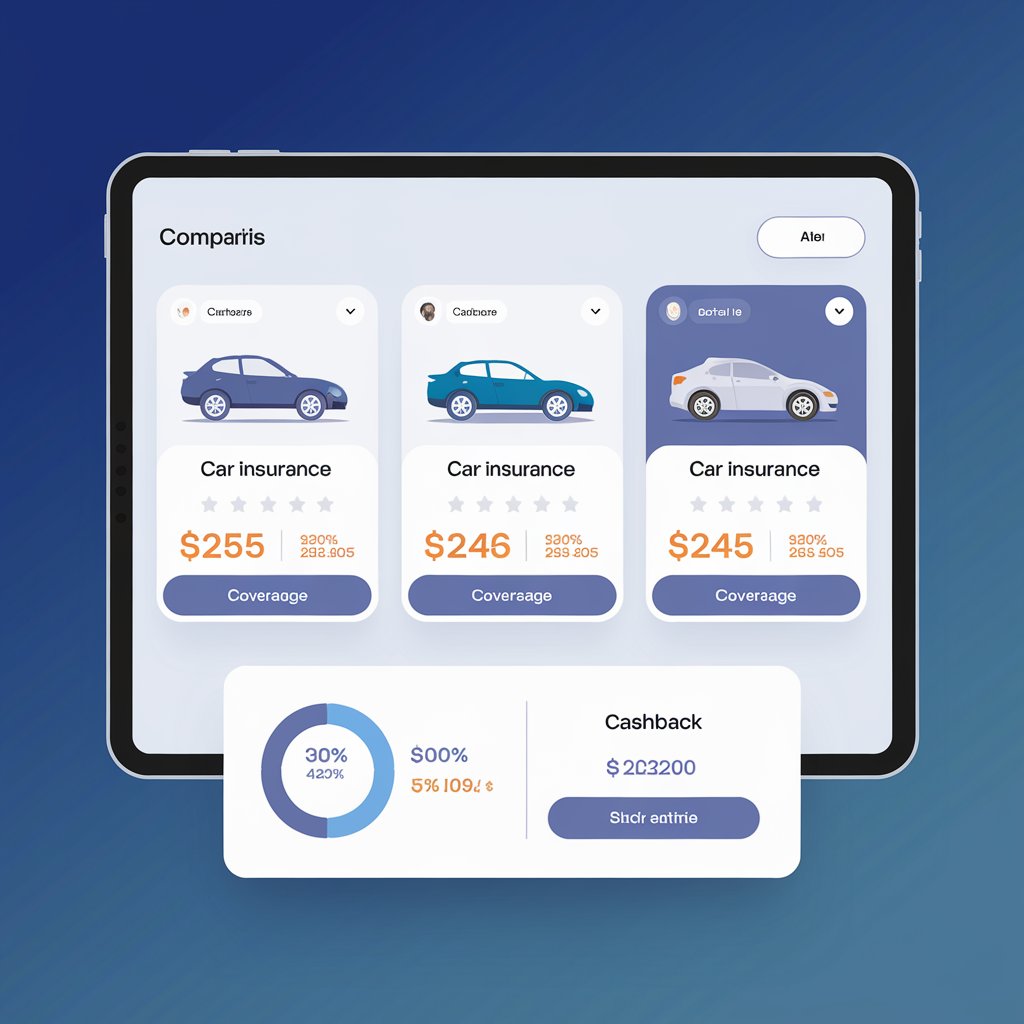

Cashback offers work by giving you a percentage of the money you spent on a service or product back into your account. This makes it a great way to save money on car insurance premiums.

How Cashback Works with Car Insurance

When you purchase car insurance through a cashback website, the platform tracks your purchase and gives you a set amount of money back once the transaction is completed. It’s a simple way to reduce the overall cost of your insurance policy.

Saving Money on Premiums with Cashback Deals

Cashback offers can be particularly beneficial for drivers looking to cut costs. Depending on the platform and insurance provider, you can get a fixed amount back or a percentage of your premium. This refund can be applied to anything, from renewing your insurance to upgrading your policy.

Types of Cashback Offers Available

There are two main types of cashback offers for car insurance:

- Flat-Rate Cashback: A fixed amount of money returned once you purchase your policy.

- Percentage-Based Cashback: A percentage of your premium returned after purchase. This type is especially beneficial for higher-cost policies.

Cashback vs. Traditional Discounts

You might be wondering how cashback compares to traditional insurance discounts. Both can save you money, but cashback offers provide immediate savings after your purchase, whereas discounts reduce the premium upfront. The main difference is that cashback is often a post-purchase benefit, while discounts lower your premium at the time of payment.

Long-Term Benefits of Cashback

Cashback offers not only reduce your initial costs but also provide a financial incentive for renewing your insurance with the same provider through cashback platforms.

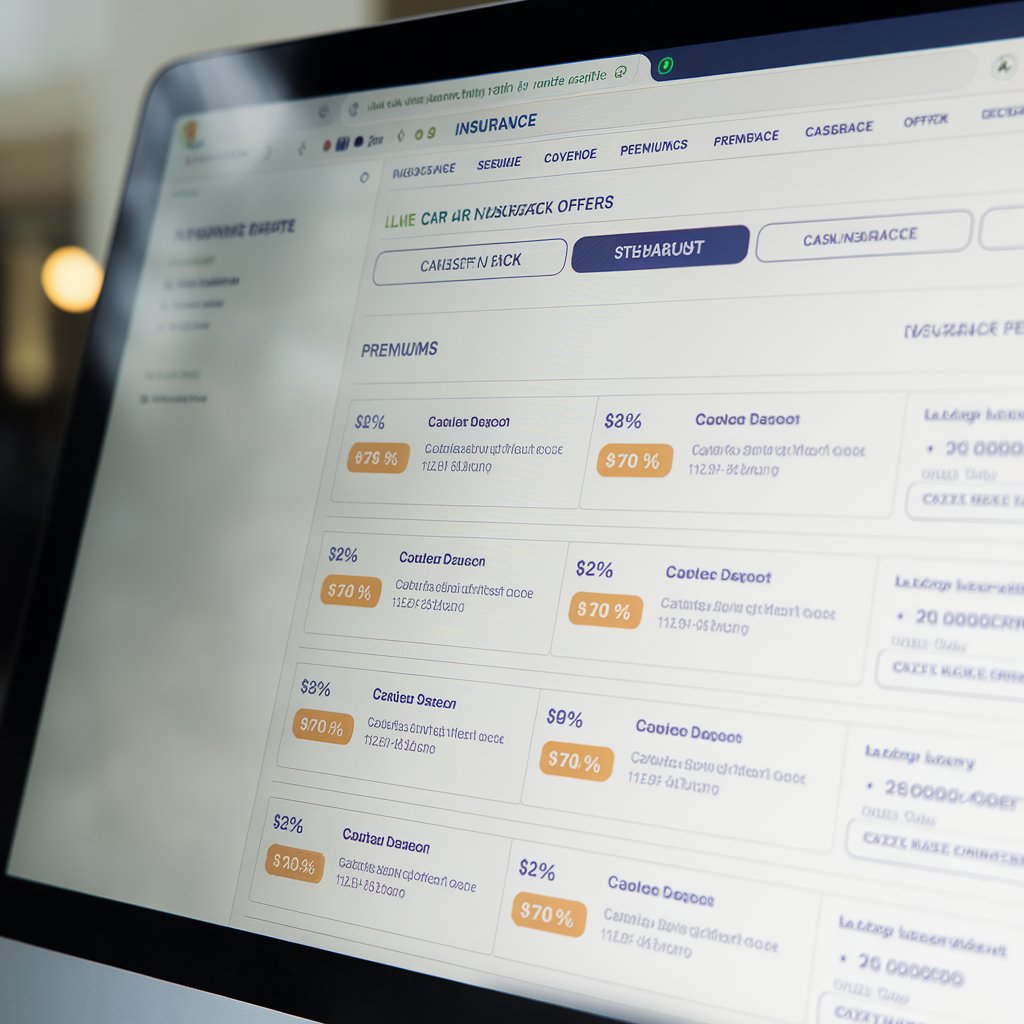

How to Compare Car Insurance Online

Comparing car insurance online is a straightforward process. Here’s a step-by-step guide:

Step-by-Step Guide to Using Comparison Websites

- Choose a Trusted Comparison Website: Start by selecting a reliable car insurance comparison platform that partners with cashback sites.

- Enter Your Information: Provide basic details such as your car’s make, model, year, and personal driving history to receive accurate quotes.

- Review and Customize: Compare the options provided and customize coverage options based on your needs.

- Check Cashback Offers: After selecting a policy, confirm whether cashback is available for that insurer and make sure to activate it before purchasing.

Key Factors to Consider When Comparing Car Insurance

When comparing car insurance policies, it’s important to look beyond just the premium. Factors to consider include:

- Coverage: Make sure the policy includes the right level of coverage (comprehensive, liability, etc.).

- Deductibles: Consider how much you’re willing to pay out-of-pocket in case of an accident.

- Premiums: Compare how much you’ll be paying monthly or annually for your insurance.

Top Platforms Offering Online Car Insurance Comparison

There are numerous platforms available for comparing car insurance, but some stand out for their ease of use and cashback offers. Popular platforms include:

Popular Comparison Sites

- Compare the Market

- GoCompare

- MoneySuperMarket

- Confused.com

These platforms often partner with cashback websites to offer additional savings on top of competitive premiums.

Cashback Partnerships

Cashback sites such as TopCashback and Quidco frequently collaborate with comparison platforms to provide exclusive cashback offers for car insurance purchases.

Maximizing Savings with Cashback and Promotions

To make the most of cashback offers, timing is key. By combining cashback offers with promotional periods or seasonal deals, you can significantly reduce the cost of your insurance.

Timing Your Purchase During Sales or Promotions

Some cashback offers are only available during specific times of the year. For example, many cashback sites run promotions around major sales events like Black Friday or at the end of the financial year.

Stacking Cashback Offers

Some insurers allow you to stack cashback with other promotions or discounts, such as bundling your home and auto insurance policies together. Make sure to read the terms of your cashback deal to ensure eligibility.

How Safe Is Using Online Comparison and Cashback Offers?

Online car insurance comparison platforms and cashback websites take security seriously, but it’s always important to ensure your data is protected.

Security Features of Comparison Websites

Top comparison websites use encryption to secure your personal information. Always check that the platform uses HTTPS (the secure version of HTTP) to ensure safe transactions.

Trustworthy Cashback Sites for Car Insurance

Leading cashback websites such as TopCashback and Quidco are reputable platforms with strong security measures in place. These platforms often have long-standing partnerships with major insurance providers, ensuring that cashback offers are legitimate.

Legal Considerations When Using Cashback Offers

Depending on where you live, there may be regulations around using cashback offers for purchasing car insurance. Some states in the U.S., for example, have restrictions on offering cashback deals with insurance products due to potential conflicts with insurance laws.

State Regulations

Be sure to check whether cashback offers are legal in your state or country before making a purchase, as some regions may have specific rules.

Outline

H1: Introduction

- The rise of online car insurance comparison tools

- How cashback offers can make car insurance more affordable

H2: Why Compare Car Insurance Online?

- Convenience and speed of online comparison platforms

- Access to multiple quotes in minutes

- Customizing coverage to suit your needs

H2: The Benefits of Using Cashback Offers

- How cashback works with car insurance

- Saving money on premiums with cashback deals

- Types of cashback offers available

H3: Cashback vs. Traditional Discounts

- Key differences between cashback and insurance discounts

- The long-term benefits of cashback

H2: How to Compare Car Insurance Online

- Step-by-step guide to using comparison websites

- Key factors to consider: coverage, deductibles, and premiums

H3: What to Look for in a Good Car Insurance Policy

- Comprehensive vs. liability-only coverage

- Additional features such as roadside assistance, rental car coverage, etc.

- Reading customer reviews and ratings

H2: Top Platforms Offering Online Car Insurance Comparison

- Popular comparison sites in the market

- Cashback partnerships and how to maximize savings

- Features that make these platforms user-friendly

H3: How to Use Cashback Sites Effectively

- Registering on cashback websites

- Linking cashback accounts to car insurance platforms

- Common pitfalls and how to avoid them

H2: Maximizing Savings with Cashback and Promotions

- Timing your purchase during sales or promotions

- Stacking cashback offers with other discounts

- Seasonal deals and insurance renewals

H3: Common Cashback Offers for Car Insurance

- Flat-rate cashback offers

- Percentage-based cashback offers

- Cashback on multi-policy bundles

H2: How Safe Is Using Online Comparison and Cashback Offers?

- Security features of comparison websites

- Protecting your data when using cashback platforms

H3: Trustworthy Cashback Sites for Car Insurance

- Well-known and secure cashback websites

- How to verify legitimacy of cashback platforms

H2: Legal Considerations When Using Cashback Offers

- State regulations on cashback for insurance purchases

- How cashback offers interact with insurance laws

H2: Conclusion

- Summary of the benefits of online comparison and cashback offers

- Final tips for maximizing your savings

H2: FAQs

- What is the advantage of using cashback for car insurance?

- How do I find the best cashback offers for car insurance?

- Are cashback websites safe for comparing car insurance?

- Can I combine cashback with other car insurance discounts?

- Do all car insurance companies offer cashback?

Introduction

In today’s fast-paced world, getting car insurance doesn’t have to be a lengthy process. Thanks to online comparison tools, finding the right policy is easier than ever. But what if you could not only save time but also get a cashback bonus when purchasing your insurance? Cashback offers have grown in popularity, allowing savvy consumers to get a portion of their money back after completing their purchase.

In this article, we’ll explore how to compare car insurance online while taking advantage of cashback offers, and how you can maximize your savings on both fronts.

Conclusion

Online car insurance comparison combined with cashback offers is a smart way to save both time and money. By taking advantage of these platforms, you can get multiple quotes in minutes and receive a portion of your premium back after purchase. Remember